Economic

Before Cyclone Mandous makes landfall, there is a lot of rain on the east coast.

The east coast is bracing for Cyclone Mandous, which is expected to make landfall in the coming days. In the meantime, the region is experiencing a lot of rain, which is causing flooding in some areas.

The cyclone over southwest Bay of Bengal intensified on Thursday and remained severe on Friday. It lay centred off north Tamil Nadu and Puducherry coasts, about 310 km north of Trincomalee (Sri Lanka) and about 210 km south-southeast of Chennai.

The cyclone is likely to move northwestwards and cross north Tamil Nadu, Puducherry and adjoining south Andhra Pradesh coasts on Friday. It will make landfall as a cyclonic storm with wind speed of 65 to 75 kmph, gusting to 85 kmph near Mahabalipuram.

Group Media Publications

General News Platform – https://ihtlive.com/

Entertainment News Platforms – anyflix.in

Construction Infrastructure and Mining News Platform – https://cimreviews.com/

Podcast Platforms – https://anyfm.in/

World

Exceptionally high’ economic risks exist in Pakistan, according to an IMF report

Pakistan, like many countries, faces a range of economic challenges that impact its growth, stability, and development. A recent report from the International Monetary Fund (IMF) has drawn attention to the existence of “exceptionally high” economic risks in Pakistan. This blog aims to examine the key findings of the IMF report, explore the underlying factors contributing to these risks, and discuss the potential implications for Pakistan’s economy.

Pakistan: IMF Bailout Should Advance Economic Rights

Pakistan’s recent agreement with the International Monetary Fund (IMF) for a bailout package presents an opportunity to advance economic rights and improve the well-being of its citizens. As the country faces significant economic challenges, including a high fiscal deficit and external imbalances, the IMF’s financial assistance can provide much-needed stability and support for Pakistan’s economy. However, it is crucial that the bailout conditions are designed with a focus on protecting and promoting the economic rights of the most vulnerable populations. This includes ensuring access to essential services such as education, healthcare, and social protection programs, while also addressing income inequality and promoting inclusive economic growth. By prioritizing economic rights in the implementation of the IMF bailout, Pakistan can create a more equitable and sustainable economic system that benefits all its citizens.

The IMF Report: Identifying Exceptionally High Risks

The IMF report highlights several critical factors that contribute to the exceptionally high economic risks faced by Pakistan. These include fiscal imbalances, a fragile external position, elevated public debt, and structural issues. The report emphasizes the need for decisive policy actions to address these challenges and enhance economic resilience.

Fiscal Imbalances: Pakistan’s fiscal deficit, driven by a mismatch between government revenues and expenditures, poses a significant risk to the economy. The report underscores the importance of fiscal consolidation measures to bring spending in line with revenues and reduce reliance on borrowing.

Fragile External Position: Pakistan’s external accounts face vulnerabilities, including a high current account deficit, limited foreign exchange reserves, and external debt repayments. The IMF report stresses the need to improve the country’s export competitiveness, attract foreign direct investment, and enhance foreign exchange inflows.

Elevated Public Debt: Pakistan’s public debt burden has been rising, raising concerns about debt sustainability and servicing capacity. The report highlights the importance of debt management strategies, fiscal discipline, and revenue mobilization to address this issue effectively.

Structural Challenges: The IMF report also identifies structural issues that hamper Pakistan’s economic growth potential, including weak governance, inefficiencies in the energy sector, and low productivity. Addressing these challenges requires comprehensive reforms to improve governance, enhance the business environment, and boost productivity across sectors.

Implications and the Way Forward

The IMF report’s findings indicate that addressing the exceptionally high economic risks in Pakistan requires concerted efforts from the government, policymakers, and relevant stakeholders. Failure to take prompt and effective measures could result in increased vulnerability, hinder economic growth, and impede progress towards social development goals.

To navigate these challenges, Pakistan must prioritize the following actions:

Fiscal Discipline and Reforms: Implementing sound fiscal policies, including revenue enhancement, expenditure rationalization, and effective public financial management, is crucial for long-term fiscal sustainability.

Strengthening External Resilience: Encouraging exports diversification, attracting foreign investment, and improving the balance of payments position are essential for reducing external vulnerabilities and enhancing economic stability.

Debt Management: Instituting prudent debt management practices, including prioritizing concessional borrowing, monitoring debt levels, and ensuring debt repayment capacity, is critical to mitigate the risks associated with the country’s debt burden.

Structural Reforms: Undertaking comprehensive structural reforms to improve governance, enhance the business environment, promote competition, and increase productivity across sectors will support sustainable and inclusive economic growth.

The IMF report highlighting “exceptionally high” economic risks in Pakistan serves as a wake-up call for policymakers and stakeholders to take swift and decisive actions. Addressing fiscal imbalances, strengthening the external position, managing public debt, and implementing structural reforms are vital steps towards achieving sustainable economic growth, stability, and resilience.

By embracing prudent economic policies, fostering an enabling business environment, and prioritizing governance reforms, Pakistan can navigate these challenges and unlock its full economic potential. It is through concerted efforts and collaboration that the country can pave the way for a prosperous future, ensuring improved living standards and opportunities for its citizens.

General News Platform – https://ihtlive.com/

Entertainment News Platforms – anyflix.in

Construction Infrastructure and Mining News Platform – https://cimreviews.com/

Podcast Platforms – https://anyfm.in/

India

As the government raises the VAT, diesel in flood-affected Himachal would cost 3/l higher.

.jpg)

Shimla, Himachal Pradesh – In the aftermath of devastating floods that have wreaked havoc in parts of Himachal Pradesh, residents are now faced with another blow as the government has decided to raise the Value Added Tax (VAT) on diesel. The hike in VAT will result in a price increase of ₹3 per liter for diesel in the flood-affected areas. This development comes as a concerning development for the already burdened residents who are struggling to recover from the catastrophic impact of the floods.

The decision to increase the VAT on diesel was taken by the state government as part of revenue generation efforts to aid in the recovery and reconstruction process after the floods. However, this move has drawn criticism from various quarters, particularly from the residents who are grappling with the aftermath of the disaster.

The increased price of diesel will have wide-ranging implications for the affected areas. The transportation sector, which heavily relies on diesel, will bear the brunt of the price hike, leading to increased costs for goods and services. Additionally, farmers and businesses dependent on diesel-powered machinery for agricultural and industrial activities are expected to face additional financial strain.

The government, while acknowledging the concerns raised by the public, defended the decision, stating that the revenue generated from the increased VAT on diesel would contribute to the rehabilitation and reconstruction efforts in the flood-affected regions. They emphasized the need for financial resources to undertake urgent repairs, restore infrastructure, and provide relief to affected communities.

However, critics argue that imposing a price increase on diesel could potentially exacerbate the hardships faced by the residents, who are already grappling with the aftermath of the floods. The move has sparked debates regarding the timing and appropriateness of such a decision, given the delicate socio-economic conditions prevalent in the affected areas.

As the news of the diesel price hike spreads, local communities, activists, and political leaders are calling on the government to reconsider its decision and provide relief measures to mitigate the financial burden faced by the flood-affected population. They emphasize the importance of ensuring that the recovery process does not add further hardships to an already vulnerable population.

In response to the public outcry, the government has expressed its willingness to review the decision and assess the potential impact on the affected residents. It is expected that discussions will take place to find a balanced approach that addresses the financial needs for reconstruction while also considering the welfare of the affected communities.

The situation remains fluid, and the government’s response to the concerns raised by the public will be closely watched. In the meantime, residents of flood-affected areas in Himachal Pradesh continue to grapple with the challenges posed by the natural disaster and its subsequent repercussions on their lives and livelihoods.

General News Platform – https://ihtlive.com/

Entertainment News Platforms – anyflix.in

Construction Infrastructure and Mining News Platform – https://cimreviews.com/

Podcast Platforms – https://anyfm.in/

Business

Srikanth Venkatachari is appointed as the new chief financial officer by Reliance Industries.

As senior advisor to Reliance Chairman Mukesh Ambani, he succeeds Alok Agarwal, who had served in the position of CFO since 2005

According to a late-evening press announcement from the firm, Srikanth Venkatachari has been named as chief financial officer of Reliance Industries Ltd, effective June 1.

As senior advisor to Reliance Chairman Mukesh Ambani, he succeeds Alok Agarwal, who had served in the position of CFO since 2005.

He succeeds Alok Agarwal, who has served as the company’s joint CFO since 2005, and will assume full control on June 1.

Srikanth Venkatachari has been appointed as the new chief financial officer of Reliance Industries. He will be responsible for the financial planning and analysis of the company. He will be based in Mumbai and will report to the company’s chairman and managing director, Mukesh Ambani.

Group Media Publications

General News Platform – https://ihtlive.com/

Entertainment News Platforms – anyflix.in

Construction Infrastructure and Mining News Platform – https://cimreviews.com/

Podcast Platforms – https://anyfm.in

-

India11 months ago

India11 months agoThe afternoon briefing revealed that 97.26% of the ₹2000 notes were returned, and the Israeli Prime Minister committed to war goals.

-

World4 months ago

World4 months agoMichigan splash pad attack: A couple was shot seven times in total while defending their two small daughters.

-

Business2 years ago

Business2 years agoSrikanth Venkatachari is appointed as the new chief financial officer by Reliance Industries.

-

Entertainment1 year ago

Entertainment1 year agoNew Season 8 The Walking Dead trailer flashes forward in time

-

India1 year ago

India1 year agoPM Modi’s Three-Nation Tour Begins with a Traditional Welcome in Papua New Guinea

-

India Hot Topics1 year ago

India Hot Topics1 year agoCenter ‘busts’ 8 YouTube channels for distributing false information.

-

Business7 years ago

Business7 years agoThe 9 worst mistakes you can ever make at work

-

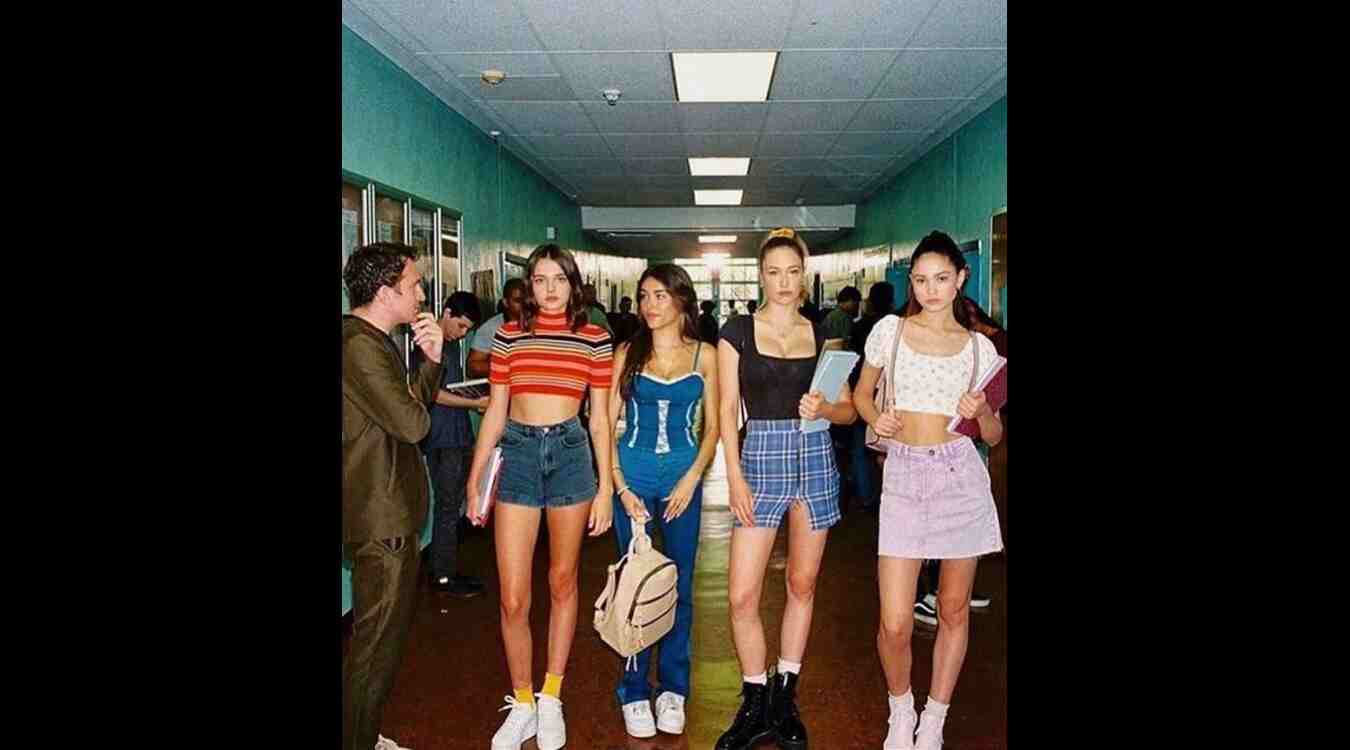

Fashion7 years ago

Fashion7 years agoThese ’90s fashion trends are making a comeback in 2017